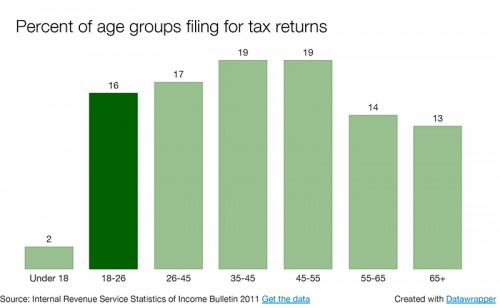

For DePaul junior Rita Lachmansingh, filing her taxes for the first time was a complex process. Lachmansingh, who works for Red Bull, knew little about taxes and even less about the kind of return, if any, she’d receive.

“I just know taxes took a lot of my money,” Lachmansingh said. “I gave my mom my W-2 and she helped me file, but I have no clue what goes into it. I only got like $50 so I just bought my groceries.”

For students who work and have had income taxes taken out of their paychecks, filing their taxes may have first seemed daunting, but according to Natalie Daniels, Assistant Director at DePaul financial fitness, filing is a quick and simple process.

“Filing taxes as a student is generally pretty easy, you can usually use one of the free file programs either from the IRS or other tax servicers,” Daniels said. “Once you get your W-2 from your employer, students can really just go into an online system and plug in numbers from their W-2 and hit submit.”

Sophomore Maryna Smoliana works as a part-time office assistant at DePaul and had an easy time filing her taxes. Smoliana works an average of 20-25 hours per week and was a first time filer this tax season. “It was really easy, definitely easier than I thought it was going to be,” she said. “It took like 30 minutes to do it all on TurboTax.” Smoliana received a tax refund and put it towards tuition and school expenses.

Daniels said students should not be intimidated by tax season, but rather hopeful of the return they may now receive.

“The biggest mistake I see students doing is that they don’t file because they think them filing will screw up their FAFSA or will make them not dependent on their parents anymore,” she said. “By not filing their taxes they’re missing out on refunds because most students aren’t making enough money to really have to pay in.”

Student who filed this year may be receiving tax refunds within the next couple of weeks. Though the refund may be minimal, for many students the refunds are dollars that they previously did not have or expected to have. “If you do get a refund, it is one of the easiest ways to save money,” Daniels said. “For a student that is going throughout the year on a tight budget they could potentially use that tax refund as one way to start ramping up their savings.”

Many students have decided to use their tax refunds to save money rather than indulge. Senior Mark Wilbur decided to save most of his tax refund while also spending a bit of it on a trip to Nashville. “I used TurboTax,” he said, “This was my second time filing, but before the first time, I didn’t understand taxes at all.”

Daniels suggests that students save whatever money they receive this tax season. “I think everyone should have a savings account,” she said. “Having a separate account for that money and making sure you’re putting that money directly into that savings account helps.”

Though it is difficult to save money as a student, setting reachable goals and having a set idea for what you are saving for encourages students to put aside some cash. “Having something you are saving for is really important,” Daniels said. “There’s a lot of little things you can do to help. You can name your account on your online banking. Let’s say a student was saving for study abroad, they can name that account “France,” and it therefore becomes harder to transfer money out of that account.” Daniels also recommends students have at least $300 in savings to serve as an emergency fund.

As for how to approach the next tax season, students should file early and without fear.

“I think students are very intimidated by the process, for most students it’s going to last 10 to 15 minutes so really, demystifying the anxiety about it is all it takes,” Daniels said. “It’s serious, but it’s not challenging.”