Student loan accumulation not understood by half of borrowers

May 7, 2018

After accomplishing the main goal of getting into college and choosing the right fit, one of the first burdens many students face is figuring out how they will pay for their education.

The reality sinks in when many students sit down and, combing through financial aid packages, find that some loans may be more than necessary to help pay for the academic year.

In 2015 Business Insider reported that between 1980 and 2014 college tuition increased by almost 260 percent.

Earlier this year Student Loan Hero, an online guide and website that aims to help students understand their loans, reported that in 2017 the average college graduate heads into the workforce with nearly $40,000 in student loan debt. This month they also reported that for borrowers aged 20 to 30 years old, the average monthly loan payment is $351.

Many students are also burdened with decisions about living on campus, travel, meal plans, expensive textbooks, additional fees, and cost of attaining a college education in America. Financial decisions also become important as students choose the loan that works best for them and their future as a college graduate.

These are some of the reasons that students tend to accept loans offered to them through various lenders. Among the types of loans students are likely to see are the subsidized and unsubsidized varieties.

Student Loan Hero also reported that 52 percent of student loan borrowers lack proper understanding of how their loan accumulates interest. Many even believe that their loans don’t collect interest while they are still enrolled in school.

“I do this work all the time and will go into a class and ask students, ’What‘s the interest rate on loans this year,’ and it’s rare that people can answer that question,” said Natalie Daniels, assistant director at DePaul Central.

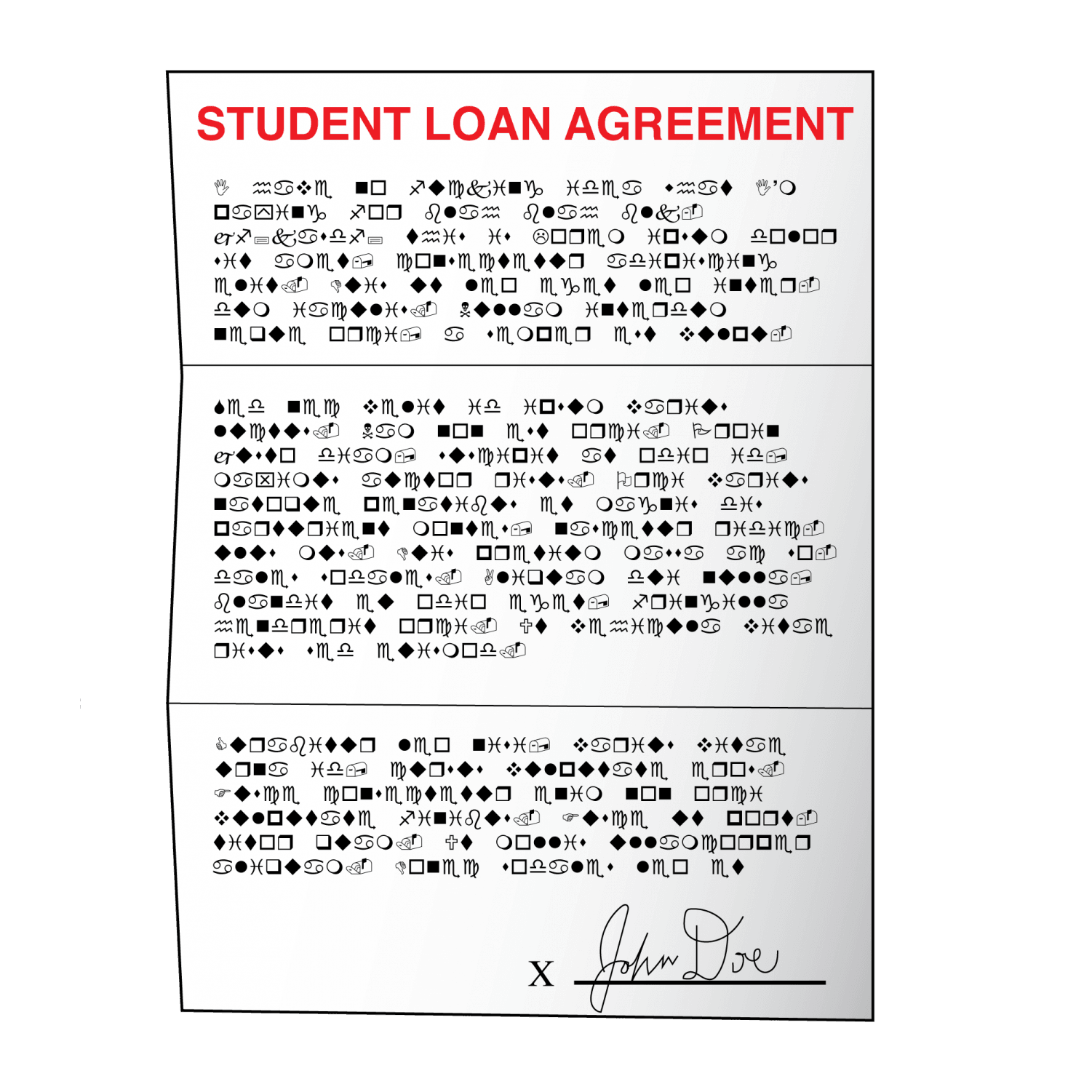

“People don’t necessarily have the information. They should because they supposedly go though entrance counseling and sign a master promissory note, but we all know people don’t read that particular carefully. I wouldn’t say most students understand their loans,” Daniels said.

Despite not fully reading the fine print or understanding the results and interests tacked onto the loans, many students still accept, for a variety of reasons.

“I think the lenders provide information, but I think as with any loan, like a mortgage or a car loan, that they advertise it to students from the most positive perspective possible,” said Edward Doyle, an adjunct professor at DePaul who teaches accounting.

“But students do have to do research on or get an understanding, that (an) interest rate is very low but can change over time, and that is particularly critical now as interest rates are going up,” he said.

Lisa Jenkins, a DePaul graduate, realized this after she graduated. She couldn’t understand why her student loan amount had grown so immensely, adding further stress to her job search.

“ I would just kind of accept all the loans being offered to me. But, in the end, it’s pretty confusing, “ Jenkins said.

“At the time that I accepted them it didn’t seem like a lot of money, but it was. I didn’t know that much about them, except that I needed them to go to school. I didn’t really have any other options anyway,” she added.

Jenkins is not alone in her experience. She is one of the many college students across the nation who accept loans just so they can pay basic tuition costs.

According to Miranda Marquit, a personal finance expert at Student Loan Hero, oftentimes students accept unsubsidized loans – which accrue interest even while the student is still in school – after they have exhausted other financial options.

“The reality is that if you don’t have your own funds or a scholarship, you probably can’t afford schooling unless you use unsubsidized loans. The amount you borrow in subsidized loans rarely covers the entire cost of school,” she said.

I had both subsidized and unsubsidized loans during my time in college, mainly because the subsidized loans aren’t enough to get the job done,” she said.

Marquit also agrees that more could be done to help increase students’ understanding of loans, which could help them make better financial decisions. She acknowledges, however, that some of the cause for confusion and misinformation often comes from the loan services themselves.

“One of the biggest issues is that federal loan services don’t always give out accurate information. They might not help borrowers understand which income-driven repayment plan they are eligible for, and sometimes they don’t have correct information about the requirements of Public Service Loan Forgiveness. It would be nice to see better training of representatives on these programs and greater efforts to provide accurate information about the requirements,” she said.

In fact, when it comes to loan forgiveness, many college students are also under the false impression that their loans can be forgiven, when it may not be the case.

“Students need to learn about what types of loans they actually have, and they need to be well-versed in the different programs available. They need to realize that not all loans qualify for forgiveness programs. So before you move forward, check the requirements of the forgiveness program and make sure your loans are eligible,” she said.

When determining which loans are the best fit, Marquit advises students to review interest rates and consider whether a private, rather than a federal loan has more financial benefits for them. There are also several websites and resources on campus that can help make some of these financial decisions easier to understand.

Daniels and Marquit agree that a better job needs to be done on informing students of the stipulations that come along with the loans they accept.

“I do think that we need better financial education around the cost of attending school and the implications of borrowing money to pay for college. The reality is that we just go to school, and the loan exit counseling is often insufficient. We need to teach students how to think about their degree and work ahead of time to decide whether it’s worth the cost,” Marquit said.

Daniels hopes that in the future more attention will be placed on educating students about loan operations. As future economic changes result in the rise and fall of tuition prices and varying loan interest rates, this becomes increasingly important to college students.

“I think more awareness at every level is important,” she said.

“My dream would be to be able to get a two-credit class that students would have to go through, or even an appointment with a person rather than just going through online calculations.”

“I know how easy it is to skip through that and not really read it. Just having someone that they can sit down with to explain things, I think, would be really great. It could be a class that talks about more than just loans, (such as) a class about basic finance, because it’s all tied together,” she said.

In the U.S. student loan debt is reportedly over a trillion dollars. Educating students about their loans, the effects of their loans, and how to choose the right loans could be a step towards decreasing that number.