As families and friends gather to take photos and congratulate the recent graduates for all their hard work and accomplishments, we have to think about what is really being celebrated. Unfortunately for many students, their future includes unemployment and student loans.

After high school, college is the next step students are told they need to take if they want to succeed in life. However, it is not always possible because of such high costs and the repayment of loans.

The cost of a four-year college education is two and a half times the amount it was in the 1978-79 school year, according to the New York Times. However, a report by the Economic Policy Institute found that the median family income has only increased 20.2 percent between the 1978-79 to the 2016-2017 enrollment year.

As a result of such high costs but not earning enough money to pay for college, more students have no choice but to take out loans to pay for their education. The total student debt is currently $1.3 trillion, which is more than double the amount it was in 2008, according to the New York Times.

Compared to previous years after the Great Recession, the future looks bright for many graduates, but in reality there has not been much improvement. According to a report by the Economic Policy Institute, the Class of 2017 still faces economic challenges because of unemployment and low wages.

Graduating senior Hajrije Kolijma recalls the skepticism that comes with graduating in this economy.

“To be completely honest, I was much more optimistic about finding employment a month ago. I have seven total professional experiences and am graduating summa cum laude, yet I have interviewed and applied for a few jobs and have ended up only with rejections,” Kolijma said. “While I want to remain hopeful that I will find a job, that will pay me, I don’t think I will be obtaining a job I’m actually interested in any time soon. As a consequence, I’ll be working on my creative work and research and traveling instead for the months to come.”

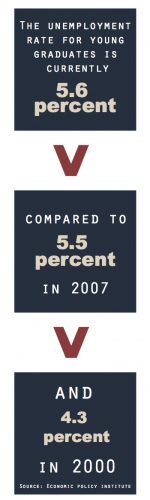

The unemployment rate for young graduates is currently 5.6 percent, compared to 5.5 percent in 2007 and 4.3 percent in 2000. The report also found 9.9 percent of graduates, such as Kolijma, are neither enrolled nor employed, compared to 8.4 percent in 2007 and 8.6 percent in 2000.

Even if recent graduates are employed, many of them are not earning enough and have not increased their living standards. According to the report, the average wage for young graduates is $19.18 per hour, only a 1.4 percent increase since 2000.

(Victoria Williamson / The DePaulia)

Students should begin looking into how they plan on paying off their student loans before graduation and how much each monthly payment will be.

However, it might soon become even more difficult for graduates to receive assistance in making payments and managing their repayment options. Betsy DeVos, the newly appointed secretary of the Department of Education, recently announced plans to reduce the number of debt collecting companies from nine to one.

Whether there are nine or one loan servicing company, the most important factor should be guiding students. Owing thousands of dollars in student loans is difficult enough, so graduates need to know they will receive the service they need to successfully pay off their loans in their lifetime.

The feelings of post graduation are mixed. Leaving students like Kolijma unsure of America’s current education system.

“Unfortunately, my outlook on the country’s education system right now is really grim. The proposed budget of this ‘presidency’ will be cutting $9 billion from education when education is the area that needs much more funding than it currently does,” Kolijma said. “However, I think the current education system — from early education to higher educations — needs a more diverse set of policy-makers, teachers and academic content.

As students graduate and prepare for adulthood, they will have to face the reality life after college will not be easy financially since there has not been much improvement regarding student loans and unemployment. Post graduation life should be a growing concern for students.