Illinois Fair Tax, explained

Justin L. Fowler/The State Journal-Register via AP

In this Feb. 7, 2019, file photo, Illinois Gov. JB Pritzker answers questions during a news conference in the governor’s office at the state Capitol in Springfield, Ill. Pritzker says he has “no concerns at all” about a media report that federal authorities are investigating a property tax break he got by taking toilets out of a Chicago mansion he owns. The billionaire told reporters Wednesday, April 24, 2019 he’s certain that any review would show “all the rules were followed” in the tax appeal.

A major question will appear on the ballot in Illinois that could have an impact on how much you have to pay for the income tax. Illinois voters will be deciding whether to amend the current flat-rate income tax to a graduated-rate structure.

The current income tax is a flat 4.95% for everyone, no matter how much you earn.

Illinoisans will have the option to vote on whether or not the tax rate should be changed from flat to graduated. Gov. J.B. Pritzker has campaigned on a promise to tax the state’s wealthier individuals more. 60% of Illinois voters must vote yes for the amendment to go into effect.

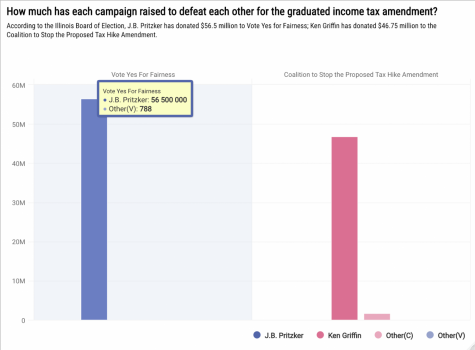

According to the Illinois Board of Election reports, Pritzker donated $5 million to Vote Yes for Fairness, a committee headed by Quentin Fulks, the governor’s former deputy campaign manager, to support the proposed graduated income tax amendment to the Illinois Constitution.

This June, Pritzker donated another $51.5 million to Vote Yes for Fairness.

Kenneth C. Griffin, another billionaire and the CEO of Chicago-based investment firm Citadel, on the other hand, donated $20 million and $26.7 million to Coalition to Stop the Proposed Tax Hike Amendment, in August and September respectively, to oppose Pritzker’s proposal of the graduated income tax amendment.

Vote Yes for Fairness has raised $56.5 million in total, over 99.9% of which was donated by Pritzker, with some minor donations from Northern Trust, a financial services company headquartered in Chicago. Coalition to Stop the Proposed Tax Hike Amendment has raised $48.3 million in total, with Griffin’s donation accounting for 96.6% of all contributions.

Pritzker said the state government faces a budget deficit due in large part to the Covid-19 pandemic. Lt. Gov. Juliana Stratton also warned the public on Sept. 24 that if Illinois voters reject the amendment of the graduated income tax proposal, Illinoisans could face a 20% income tax hike.

“To adequately address the budget crisis under our current tax system, lawmakers will be forced to consider raising income taxes on all Illinois residents by at least 20% regardless of their level of income,” Stratton said during a virtual event organized by Vote Yes for Fairness.

“We all know that our middle and lower-income families cannot withstand a 20% tax increase and it will only serve to deepen the dramatic inequities that we already see across the state,” she added. “It will drive out our residents and it will drive out investment in Illinois,” Stratton said.

Fulks and Austin Berg, the Illinois Policy Institute’s vice president of marketing, who opposed the fair tax amendment, debated on the graduated income tax amendment on WGN Radio.

Fulks said the current flat tax system is not working because it allows billionaires and millionaires to pay the same tax rate as middle-class and working families.

“What the fair tax will do is lift the burden off of middle and lower-class families and simply update Illinois’ tax system to match that the federal government uses in the majority of other states in the United States,” Fulks said.

“Right now in Illinois the bottom 20% of Illinoisans pay around 13% of their income in taxes, and the top 1% [of Illinoisans] pays around 7%,” he added. “So you know less than half or little under half the income that lower middle income class families pay, and that simply doesn’t work for us.”

Berg said that the fair tax amendment has nothing to do with fairness but rather giving the political power to Springfield politicians.

“You’re going to see that when you get a pamphlet in the mail that explains the question,” Berg said. “It doesn’t say fair in any part of the amendment or even the explanation of the amendment because if they put it in there, we get tossed off the ballot.”

“The question is about power,” Berg continued. “It’s about giving Springfield power to tax people in different and new ways and in higher ways. It’s not about fairness whatsoever.”

When asked, “is it fair that someone who’s making a million dollars pays the same percentage as someone who’s making $35 thousand?” Berg replied that the claim is a falsehood, but the more critical point is that middle classes are going to see taxes rise, and retirees are going to see the retirement tax in Illinois for the first time if the graduated income tax goes into effect.

Berg added that proponents of the fair tax amendment have never talked about how every state with a progressive income tax taxes retirement income, despite the fact that Illinois State Treasurer Michael Frerichs said in an event this summer that the graduated income tax would make it easier to tax retirement income in Illinois.

John McCarron, Chicago politics and local taxation expert and adjunct lecturer at DePaul University’s College of Communication, said it might double the income tax for those high earners, but it’s necessary to understand that Illinois is facing a budget deficit as Illinois does not tax retirement income, which represents a substantial amount of money.

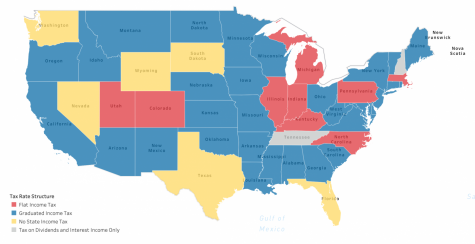

“If you are a retiree, because we don’t tax retirement income, whether it’s your Social Security check or your 401K balance that you built up for your entire career, I mean these are substantial amounts of money that we do not tax as a state income tax,” McCarron said. “I believe almost all states who have an income tax have graduated tax, so it’s kind of a good deal here in Illinois.”According to the Federation of Tax Administrators, only nine states apply a flat income tax, including Illinois. Most of the states have been changing to graduated income tax. Seven states have no income tax.”

For those states that do not apply any income tax, like Florida, Texas and Washington, McCarron pointed out that even though those states do not have income tax, they do have high sales taxes.

“If you’re thinking of Florida, I believe they have no income tax but they have quite high sales taxes, so it’s something that one would have to sit down at the kitchen table and figure out if it’s a bad deal here in Illinois or not,” McCarron said. “But my suspicion is that it wouldn’t really cause a great exodus of [wealthier] people.”

Thomas Claxton, a 22-year-old software engineer, voted yes for the graduated income tax amendment. He explained that most other states in the U.S. have a graduated income tax system, and it allows them to better fund social programs, public schools and public transit. Additionally, the state will gain more revenue from taxing the very wealthy if the amendment passes.

Other voters who supported the amendment who have responded to The DePaulia said either it would relieve budget pressures or facilitate a fairer system.

Kevin g Rae • Nov 4, 2020 at 12:59 am

does this proposed amendment go against constitution protected government pensions that do not pay state income taxes