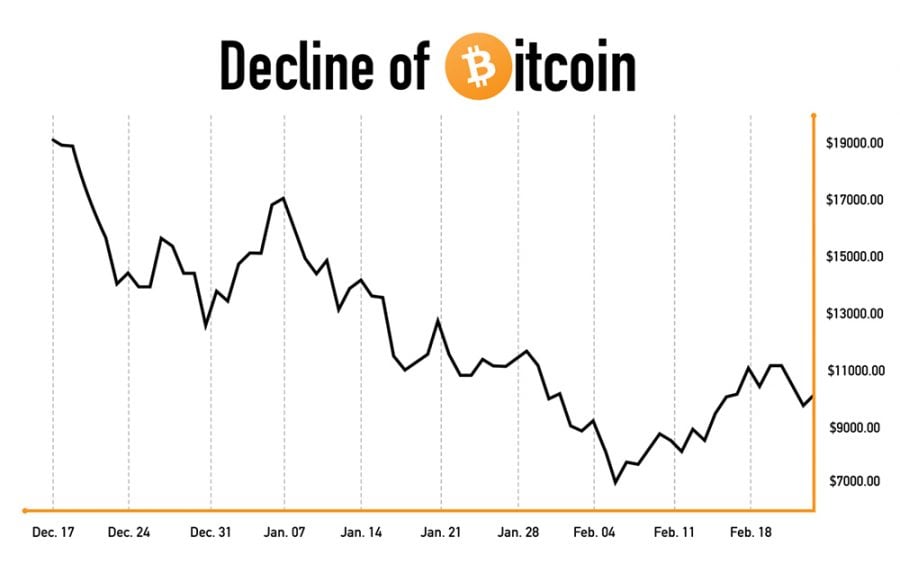

After ending 2017 with the market booming, Bitcoin crashed down January and is continuing to go down. Even with the price of Bitcoin and other cryptocurrencies going down, DePaul investors are not pulling out just yet.

The year 2017 was a good one for the cryptocurrency market. Investors were putting more into the market because it was holding steady for a while. In December, Bitcoin’s price was higher than it had been all 2017, almost at $20,000. The market fell slightly after that, though it was expected and seemed to hold steady.

And then it kept going down. By February the market dropped below $6,000. Michael Johannes, a finance student and investor, believes the crashes should be expected and the market is going to grow again.

Johannes is a long-term investor with no plans of selling his Bitcoin anytime soon. He’s seen the market crash before and is confident that prices will stabilize again.

“I’m not worried about it,” Johannes said. “I’m still investing 100 percent.”

“Speculators drove up the price to unrealistic levels,” said finance professor James Valentine.

When the numbers started going up, investors bought more. They were confident prices would continue to rise. The inflation pushed the bubble into motion. James Valentine, executive director for the Driehaus Center for Behavioral Finance, referred to the Bitcoin bubble as the “greater fool theory.”

A bubble is when an entire market is inflated with no sound foundation. When the market crashes, there’s nothing left. Johannes says most people compare it to the Internet bubble in 2000.

Bitcoin’s market is unstable. Bubbles are not uncommon due to the rapidly changing market. In the past when there was a surge in the price of Bitcoin, there would be a point when the market would crash. There were many times investors were sure Bitcoin was going to end permanently after a crash. Soon after the market would stabilize and the price would increase slowly again. Since 2010, the market has had a series of highs and lows.

In 2011, Bitcoin was up to $1,000 and went down to $230. November, 2013 may have been the worst hit to the market; Bitcoin was up $30 and crashed to a startling $.25.

Bitcoin wasn’t the only market that crashed. Other cryptocurrencies like Litecoin and Eurtheum saw their markets dip as well and the cryptocurrency market as a whole experienced a sudden drop.

Johannes believes more people started investing because they felt encouraged; they came when the price was at an all time high. But these people also don’t know what they’re doing.

“You want to be very well versed in the technology you’re buying,” Johannes said.

New investors pour their money into the market without understanding how the system works. They are not aware of how unstable the market is. Johannes suggests new investors follow better strategies, like dollar-cost averaging, instead of dumping all their money into the market at once.

“The buyer of the security (or Bitcoin) isn’t evaluating its intrinsic value but rather simply assuming someone will come along in the future and pay a higher price,” said Valentine.

Bitcoin had a long run of skyrocketing prices. However, with an unstable market, it is bound to fall at some point.

“It’s healthy for markets to consolidate after long runs,” said Mark Shore, DePaul finance professor and research officer at Shore Capital Research. “It became overbought.”

Johannes believes it’s going to be a steady climb and there’s going to be continued growth. It took nine months for the price to go from a $1,000 to $4,000, then it jumped to $20,000 in a matter of days.

“This is purely speculation, but I believe it’s going to get as high as $40,000 to 45,000,” said Johannes.

At the time of publication, Bitcoin’s price is rising again, albeit slowly, with prices currently hovering at $10,000. But cryptocurrency markets are volatile and things can change within a matter of days.

Dr Gang Chen / Feb 28, 2018 at 4:25 am

Bitcoin is a bubble for sure. However, cryptocurrencies including bitcoin will be remembered for promoting automated business trust protocols including ooleda.