DePaul students create crowdfunding portal for investors

Two DePaul students have founded VestLo, a FinTech company that operates as Illinois’ first intrastate equity crowdfunding portal.

VestLo gives local investors a cost- friendly way to invest in Illinois startups by offering low investment minimums. Investment minimums for VestLo can go as low as $5 for equity offerings while debt or preferred stock offerings have a $50 minimum investment. Illinois startups and small businesses may use the platform to raise up to $4 million in capital.

“There’s really not much of a reason to have high investment minimums,” said Dan Gordon, one of VestLo’s co-founders and a computer science graduate student at DePaul. VestLo’s other co-founder is Nick Ricciardella, an honors finance student. Equity crowdfunding, also known to some investors as investment crowdfunding or crowd equity, is part of the capital markets due to the fact that it is the online offering of private company securities to investors for investment.

Chicago’s growth in technology, small business and real estate sectors provides a larger playing field for investors using VestLo. Two of VestLo’s real estate properties are the Chicago City Soccer Club and a residential property in Chicago’s Near North Side community area.

In 2017, Chicago had 234,740 small businesses operating within its city limits, as reported by the American City Business Journals, putting it at the third most in the country behind New York and Los Angeles. Per an annual study conducted by Biz2Credit, an online credit resource that offers direct loans to small businesses, Chicago ranked No. 12 in the study’s top 25 cities for small businesses in 2018. This is up from No. 19 in 2017 and ranks ahead of cities such as Seattle, Houston and Atlanta, meaning that entrepreneurship is pouring into the city and entrepreneurs are sometimes able to utilize equity crowdfunding platforms such as VestLo.

“There’s more activity in Illinois in the start-up scene than there ever has been. And it’s not just like tech startups and stuff like that, but it’s also real estate,” Ricciardella said. “The market’s hot for real estate and you know Chicago also has all of these tech incubators you know like mHUB, 1871, UI Labs. They just keep popping up.”

Given that real estate has a high tangible asset value, investors flock to trending real estate markets to take advantage of them and VestLo seeks to capitalize on this trend. The median home value in Chicago went up to $225,600 this year, according to data from online real estate database company Zillow. Zillow forecasts that Chicago home values will rise 6.1 percent over the next year, indicating that Chicago’s real estate market is on the rise. The investment opportunities wouldn’t be possible without a change in the legal process behind equity crowdfunding. Anthony Zeoli, who was the primary drafter of the Illinois Crowdfunding Law that was built into the Illinois Securities Act in 2016, mentioned that nowadays, Illinois investors do not necessarily need to be venture capitalists or private equity employees to break into investing.

“Prior to the introduction of the Illinois crowdfunding laws, private investment in most companies, particularly in start-up and emerging companies, was reserved for high net worth and highly connected investors,” Zeoli said. “The new Illinois crowdfunding laws, which I have worked hard to get put into place and which VestLo is founded on, were created to specifically allow Illinois residents, regardless of personal wealth, to invest directly into Illinois companies, keeping investor funds here in Illinois while simultaneously helping to build and grow local business.”

Bridging the gap for investors is another thing that VestLo prides themselves on.

“[VestLo] kind of gives everyone access to that kind of investment opportunity to kind of help bridge that income inequality gap,” Ricciardella said. “You look at all the same documents […] it’s just the barrier is way lower. You’re talking about $25, $50 compared to 20 percent down payment for an investment property.”

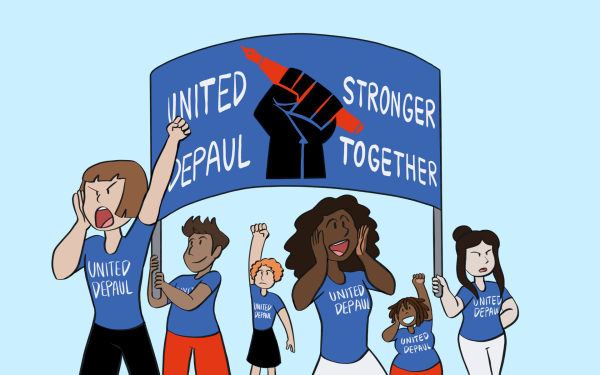

Though VestLo’s co-founders believe that their portal will positively impact investing opportunities for investors that might be well beyond their collegiate years, they hope that VestLo’s presence in the statewide investing scene will also encourage DePaul students and entrepreneurs on campus to begin their investing careers.

“We want to be in touch with the Coleman Entrepreneurship Center and bring on DePaul entrepreneurs who you know have business ideas that they want to raise money for,” Ricciardella said. “The nice thing about it would be that you could have DePaul alums and DePaul students investing in DePaul start-ups […] so it’s kind of just like the community supporting itself in a way.”