Cook County ballot measures explained

While the Right to Collective Bargaining measure is a state-wide measure on the 2022 Cook County ballot, the Cook County Forest Preserve Tax Increase Measure is local to Cook County only.

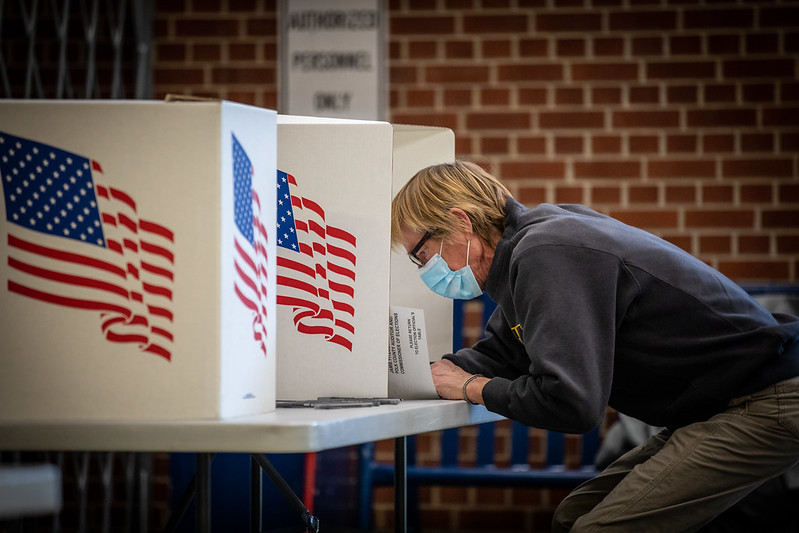

As election day approaches, it is in your best interest to understand what will be included on your voting ballot. If registered in Cook County, two ballot measures are included: a state-wide right-to-work measure and a Cook County forest preservation measure.

Illinois Amendment 1

Amendment 1, Right to Collective Bargaining Measure, is a state-wide measure to amend the Illinois Constitution. If passed, this would grant employees the “fundamental right to organize and bargain collectively through representatives of their own choosing for the purpose of negotiating wages, hours, and working conditions, and to protect their economic welfare and safety at work”.

Amendment 1, as it is known, or SJRCA0011, as it is recorded, relies on a simple majority from the voters, not the representatives. The state senate voted this issue to be decided by the general public, thus its appearance on the Illinois ballot.

This particular measure falls under the category of “right-to-work” laws: legislation expressly setting limits on worker’s right to join, or not join, a union. Sometimes used to curb mandatory union dues, right-to-work laws allow workers and individuals to decide freely their participation within a union, free of company mandate or intimidation.

This preemptive amendment, meant to protect citizens in future events from labor disputes, would overrule and outlaw any law “interfering with, negating, or diminishing the right of employees to organize and bargain collectively”. In layman’s terms, if you were to vote yes on this measure, you would be in support of state government protection and intervention of the unionization of workers.

Cook County Forest Preserve District, Illinois Property Tax Increase

The second measure on the ballot, called the Cook County Forest Preserve District, Illinois Property Tax Increase Measure, is relegated solely to Cook County. If passed, this would increase Cook County property tax by 0.025% with the expenditure relegated to forest preservation by the Forest Preservation District of Cook County.

Not only would this measure aim to expand forest preservation, but also to further protections regarding water quality, natural flood water storage and air quality as a result of the forest protection. Following the rhetoric of the two party system, a tax increase for the protection of wildlife is widely associated with a progressive ideology and an increase in property tax directly conflicts with conservative values. Though this may not be a partisan issue, those are the wide lens of this particular ballot measure.

Remember, this ballot is your ballot. Voting is the chance to clearly voice your opinions in a meaningful and actioned way. Whatever way you swing, left or right, that is, informing yourself before getting to the voting booth is the ultimate act of patriotism and contribution to your country.