DePaul advisory committee closes in on student insurance plan

Alexandro Esparza, a junior at DePaul University studying neuroscience, has been without health insurance his whole life.

Because his father is a contractor without benefits from his employers, his family does not receive health insurance as it is too expensive in the open market.

“For as long as I can remember we paid out-of-pocket,” Esparza said. “When we go to Mexico, my dad buys a three week supply of his diabetes medication because it is so much cheaper out there.”

Esparza is just one of many college students living without health insurance in the United States.

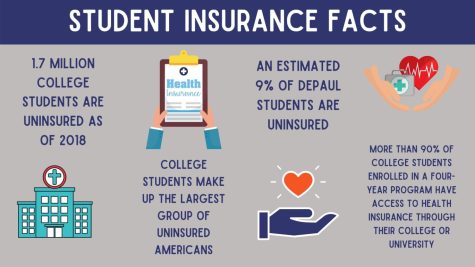

“College students constitute probably the single-largest cohesive group of uninsured Americans,” Stephen Beckley, co-organizer for the Lookout Mountain Group (LMG), a non-profit organization dedicated to healthcare reform for college students, told The DePaulia.

According to a press release from the LMG, a report found 1.7 million college students remain uninsured in 2018.

When Esparza enrolled at DePaul, he looked into receiving benefits from the university, only to find out DePaul does not offer health insurance to students.

“I’m not sure why we don’t all have insurance at this point,” Esparza said.

Last year, the DePaul Student Health Insurance Task Force conducted a survey using a representative sample of students to assess the need for health insurance at DePaul. The survey found 9% of DePaul students are uninsured, which is more than the national average of 7.9% according to LMG.

Now, DePaul students will soon have the option to receive health insurance offered by the university. The Student Health Insurance Advisory Committee, which began as the DePaul Student Health Insurance Task Force last winter, has begun the process of finalizing a healthcare plan.

According to Jay Baglia, a health communications professor at DePaul currently serving on the health insurance committee, said they will soon approve a healthcare plan which will be offered to students by the 2023 fall quarter.

Kimberlie Goldsberry, associate vice president of student affairs said the committee will be reviewing the proposal submissions to evaluate each provider, focusing on price, quality of coverage and references from other campuses using their services. The committee’s overall evaluation of each provider will be submitted to the DePaul President’s Cabinet for their review and decision-making.

“The…committee’s primary work of submitting a Request for Proposal (RFP), reviewing the proposals received and offering feedback about the providers to the DePaul President’s Cabinet by mid-December is on track,” Goldsberry said.

Once the plan is approved, the university will decide how to distribute the added cost of an insurance charge to the overall tuition fee.

“There’s going to be four companies bidding on our set of criteria,” Baglia said. “We will select a carrier sooner rather than later, and with that carrier decision, will come the price tag.”

As long as the cost of tuition does not drastically increase, students are optimistic about the new plan.

“If [the plan] is affordable, I think it could be a really good thing because I know a lot of other people don’t have insurance,” Esparza said.

Baglia said the committee is discussing the financial implications of an increase in tuition costs for students opting to receive health insurance from DePaul.

“We ran into a little bit of debate on this committee about the fact that…when we do locate and contract with an insurer, this will affect the total cost that students pay to go to DePaul,” Baglia said.

When the university implements a healthcare plan, it will be a requirement for all students unless they provide proof of a comparable plan, according to Goldsberry. The committee is unsure whether there will be an exemption option at this time.

“The vast majority of universities have student health insurance [and] require students to have health insurance,” Baglia said. “If students do not have health insurance through their parents, they are almost always required, unless an exemption can be identified, to have the university offered student health insurance.”

Even though the plan will be a university requirement, Baglia is certain it will be affordable, and DePaul will work with students to factor health insurance into financial aid.

“Student health insurance is incredibly inexpensive compared to insurance for the majority of the population,” Baglia said. “Students are young, they don’t have a lot of physical issues, so it’s easy to insure them.”

Baglia said the committee is estimating the health insurance plan will be about $2,000 to $3,000 a year.

According to Beckley, most college students without health insurance are from middle-income families that cannot afford the high cost of insurance and do not receive benefits from their place of work. Therefore, Beckley believes it is imperative all universities offer health insurance to their students.

“It’s so important to have access to good health insurance, because without it, you can really have trouble financially,” Beckley said.

Baglia, who’s role on the committee involves expressing the student need for health insurance, is also an advocate for all students receiving health insurance whether from the university they are attending, their parents or alternative means like the Affordable Care Act.

“The last thing a 21-year-old needs is a catastrophic health bill,” Baglia said. “This is not about whether you’re healthy or not, this is about the fact that a health crisis appears out of nowhere.”

To Esparza, DePaul’s decision to work on providing a health insurance plan for students is a step in the right direction.

The committee hopes to make its recommendation and finalize a plan through the board of trustees by the end of this academic year.